Section 179 Bonus Depreciation 2025 Table

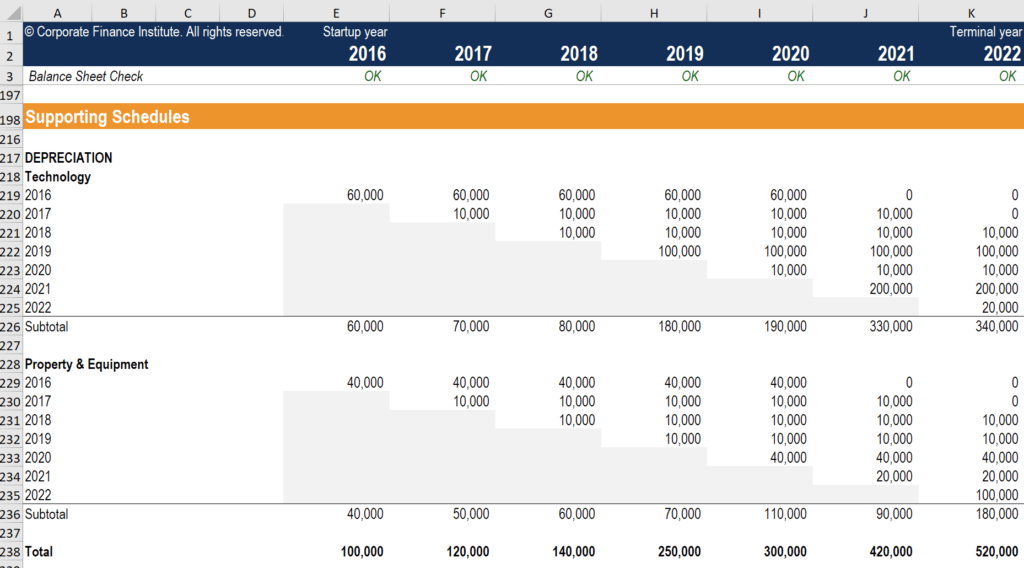

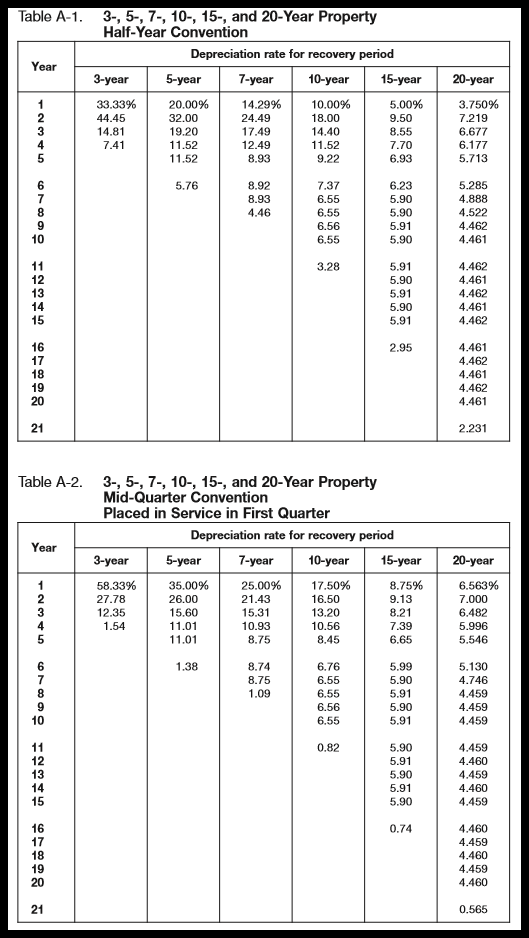

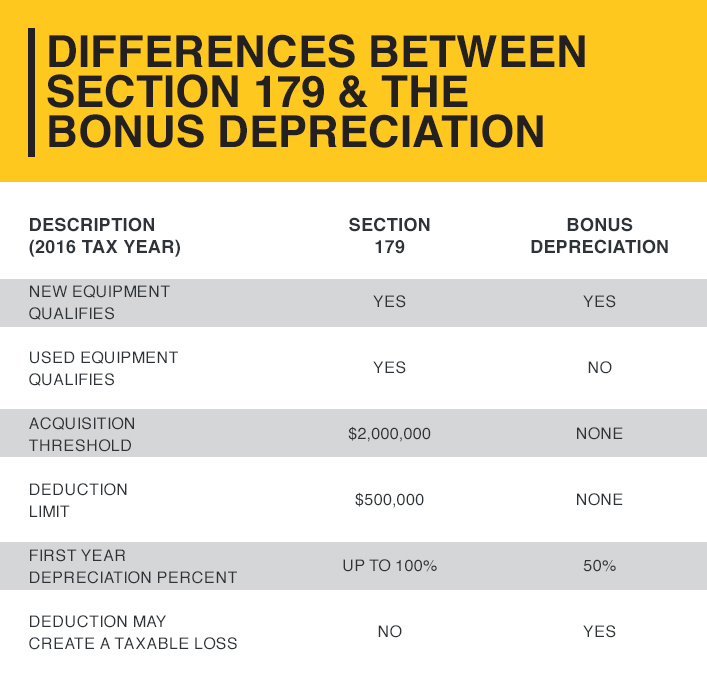

BlogSection 179 Bonus Depreciation 2025 Table - Bonus Depreciation 2025 Vehicle Helli Krystal, For 2023, businesses can take advantage of 80% bonus depreciation. Section 179 and bonus depreciation are both tax incentives that aim to encourage businesses to invest in capital assets. Section 179 Bonus Depreciation 2025 Table. This limit is reduced by the amount by which the cost of. In 2025, the bonus depreciation rate will drop to.

Bonus Depreciation 2025 Vehicle Helli Krystal, For 2023, businesses can take advantage of 80% bonus depreciation. Section 179 and bonus depreciation are both tax incentives that aim to encourage businesses to invest in capital assets.

Bonus Depreciation Calculator 2025 Nola Terrye, While bonus depreciation and section 179 are both immediate expense deductions, bonus depreciation allows taxpayers to deduct a percentage of an asset’s cost upfront. All you need to do is input the details of the equipment, select your.

How to Writeoff Your Equipment Purchases Cleveland Brothers Cat, 179 deduction for tax years beginning in 2025 is $1.22 million. Simply enter the purchase price of your equipment and/or software, and the calculator will do the rest.

2025 Bonus Depreciation Rates Dannie Kristin, The section 179 deduction can lower the cost of business equipment, and bonus depreciation may increase savings. Internal revenue code section 179 allows businesses to expense the full purchase price of qualifying equipment and/or software purchased during the tax year.

2025 Bonus Depreciation Percentage Table Nelie Xaviera, Section 179 and bonus depreciation are both tax incentives that aim to encourage businesses to invest in capital assets. Both result in substantial present value tax savings for businesses that already had.

179 Deduction 2025 Jeanne Maudie, All you need to do is input the details of the equipment, select your. You can use this section 179 deduction calculator to estimate how much tax you could save under section 179.

When considering whether to utilize section 179 deductions instead of bonus depreciation in the year 2025, it’s crucial to understand the potential impact on both cash flow and tax.

Internal revenue code section 179 allows businesses to expense the full purchase price of qualifying equipment and/or software purchased during the tax year.

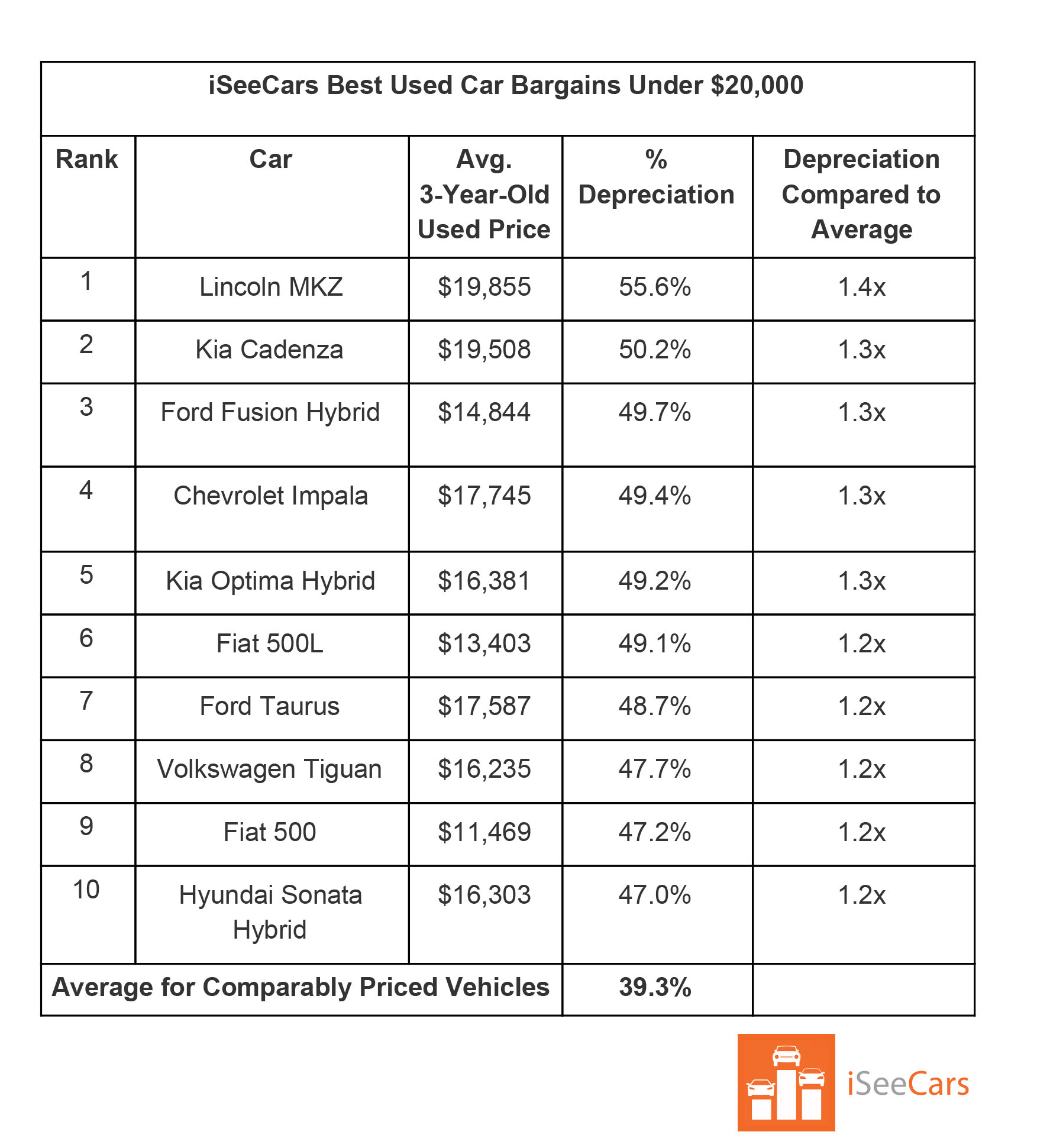

Bonus Depreciation vs. Section 179 What's the Difference? (2025), For vehicles under 6,000 pounds in the tax year 2023, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of. Simply enter the purchase price of your equipment and/or software, and the calculator will do the rest.

For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. Bonus depreciation is claimed after the section 179 expense deduction, if elected, but before the regular depreciation expense deduction.

Bonus Depreciation Calculator 2025 Nola Terrye, For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000. Bonus depreciation deduction for 2023 and 2025.

Recording the depreciation expense of an asset using section 179 or bonus depreciation can make a huge difference in the taxes you pay.